The 7th ISPE Pharma 4.0™ Survey: Digital Transformation

This article summarizes the key findings from the 7th Pharma 4.0™ Survey, conducted in 2023. It explores the demographics of the survey respondents, maturity levels of Pharma 4.0™ adoption, enabling technologies being leveraged, anticipated benefits, and challenges encountered.

Additionally, this article provides insights into future directions and projects expected to shape the next phase of digital transformation in the industry. By understanding these elements, stakeholders can better navigate the complex Pharma 4.0™ landscape and leverage digital technologies holistically to achieve sustained competitive advantage.

Digital Transformation

Digital transformation is driving gradual but impactful changes in the life sciences sector through the adoption of a wide array of advanced technologies. The Pharma 4.0™ concept embodies this revolution by integrating digital technologies and business transformation to enhance all GxP-regulated processes—including quality assurance, quality control, engineering, logistics, regulatory, pharmacovigilance—and manufacturing, supply chain, and business processes. This approach is built on the foundation of data integrity, and it fosters innovation across the entire pharmaceutical value chain. As proposed and demonstrated by the ISPE Baseline Guide Vol 8: Pharma 4.0™1 released in December 2023, this paradigm shift is not merely about implementing new technologies, but rather about creating a seamless, integrated digital and cultural ecosystem that fosters continual improvement, operational excellence, and regulatory compliance. Pharma 4.0™ therefore revolutionizes the pharmaceutical industry by leveraging innovative 4.0 technologies, including big data analytics, artificial intelligence (AI), machine learning (ML), the Industrial Internet of Things (IIoT), and cloud computing. These technologies enable real-time monitoring and control, predictive maintenance, and data-driven decision-making, ultimately enhancing the efficiency, quality, and reliability of pharmaceutical manufacturing, operations, and supply chain. However, the journey to a Pharma 4.0™ ecosystem also requires gradual improvement of organizational maturity, profound cultural transformation, rigorous data management protocols, and a steadfast commitment to ongoing learning and adaptation.

Pharma 4.0™ Survey

The Pharma 4.0™ Survey, initiated and conducted by ISPE, is a longitudinal study that supports its members by providing data-driven insights to inform decision-making and track the progress of Pharma 4.0™ initiatives. The study has been conducted annually since 2017, with data gathered from nearly 3,200 respondents across the life sciences sector. The survey respondents, who were asked about 10 questions in each edition, represented a diverse array of geographies, company types, site dimensions, and activity areas.

Some questions were kept for longitudinal analyses, but others were exchanged to explore new topics. ISPE experts and members conducted extensive and rigorous statistical evaluations of the datasets to ensure a thorough analysis of the developments within the industry. The insights from the study, presented at various ISPE and third-party conferences around the world, provide a comprehensive understanding of the evolution of Pharma 4.0™ maturity levels in the industry, as well as the challenges and benefits associated with digital transformation.

Demographics

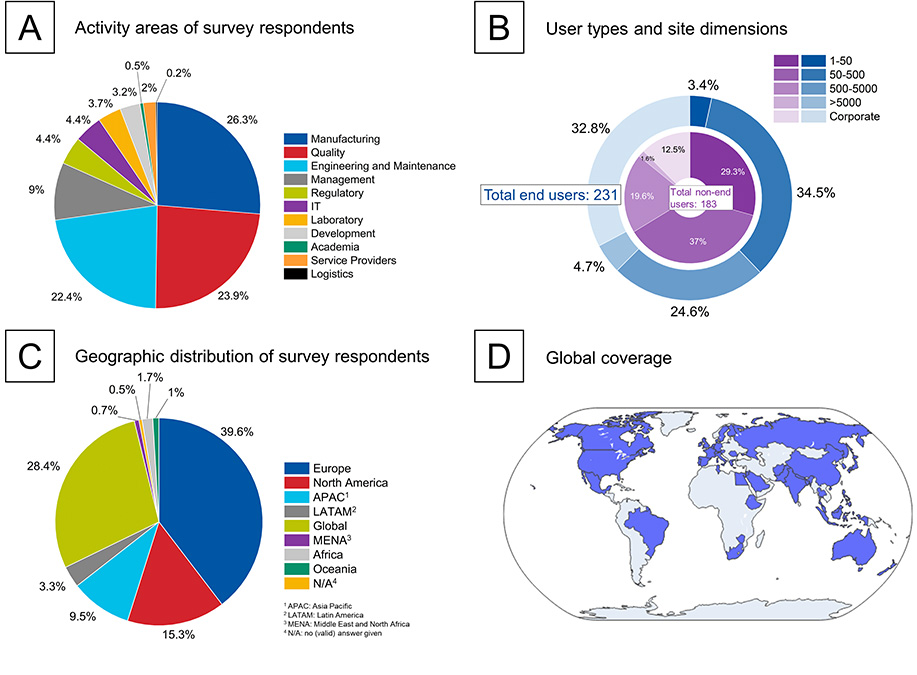

The 2023 survey sample, consisting of 418 respondents, demonstrated a diverse geographical representation with a strong presence from Europe and North America, reflecting the global reach of the pharmaceutical industry. The balance between end users and non-end users was well-maintained across various site dimensions, ensuring comprehensive representation of different organizational sizes and activity areas. This demographic spread provides a well-rounded perspective on the industry’s adoption of Pharma 4.0™ technologies and principles.

A detailed analysis in Figure 1 reveals several key insights. The survey respondents come from a broad range of professional roles and activity areas within the pharmaceutical sector (Figure 1A). Manufacturing, quality, and engineering are the dominant fields, together comprising approximately 75% of the participants. These core functions are at the forefront of the industry’s digital transformation efforts, providing critical insights and perspectives on the adoption of Pharma 4.0™ across the entire value chain.

The survey sample represents a well-balanced mix of end users and non-end users across various site dimensions (see Figure 1B). Smaller sites (1–500 employees) and larger entities (>5,000 employees) are both well-represented, ensuring that the insights capture the needs and challenges faced by both small-scale and large-scale operations. This balance helps in understanding how different-sized organizations navigate the digital transformation journey and adopt new technologies.

Regarding geographic distribution (see Figures 1C and 1D), the geographic spread of the respondents shows a strong input from Europe (39.6%) and North America (15.3%). This diverse spread reflects a range of perspectives and practices across different regulatory and operational environments. However, future surveys aim to increase representation from currently underrepresented regions in the Middle East, Africa, Oceania, and Latin America to further enhance the understanding of the global landscape.

Figure 1: Demographic breakdown and engagement of survey respondents in the pharmaceutical sector: (A) professional roles and activity areas of survey respondents, (B) segmentation of end users and non-end users by site dimensions, (C) geographic distribution of respondents (“global” refers to respondents from organizations that act on an international level or in multiple geographical territories), and (D) global coverage of the organization’s activities.

Maturity Levels

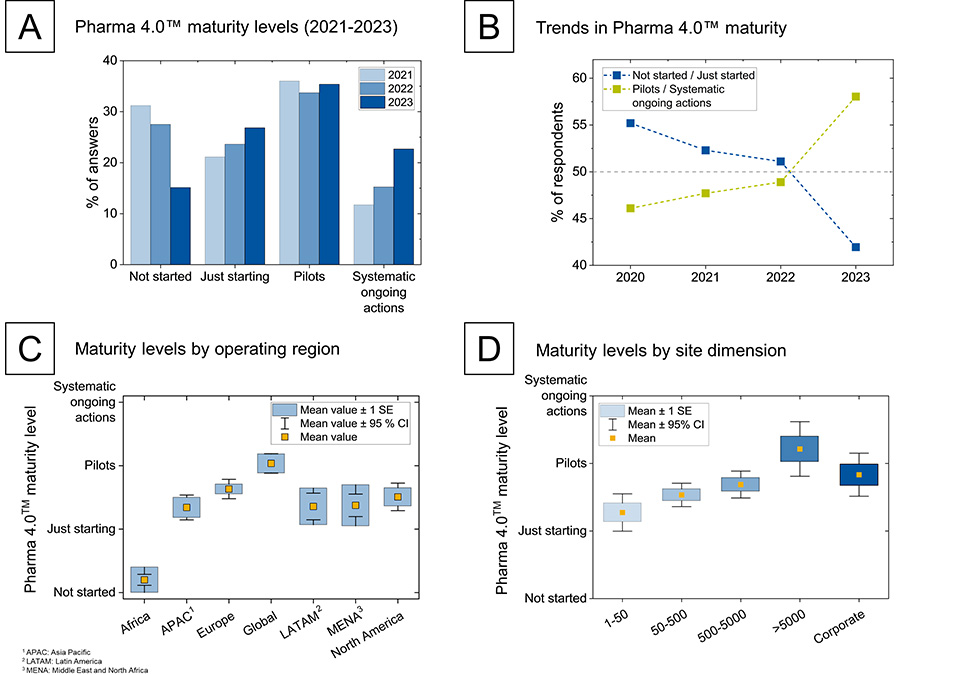

The survey findings reveal a significant shift toward higher maturity levels in Pharma 4.0™ adoption, as illustrated in Figure 2. Over the past three years, there has been a noticeable shift from the initial planning and assessment stages to the implementation of live pilots and systematic ongoing actions on a larger scale. The survey categorized the maturity levels into four stages: not started, just starting, pilots, and systematic ongoing actions.

Figure 2A shows a clear decline in the “not started” category, which dropped from 31.2% in 2021 to 15.1% in 2023. Concurrently, the “systematic ongoing actions” category experienced a significant increase, with the more advanced “pilots” and “systematic ongoing actions” categories collectively accounting for 58.1% of the total responses (see Figure 2B). This indicates that more organizations are progressing beyond the initial stages of Pharma 4.0™ adoption, underscoring the industry’s overall movement toward a more mature and integrated approach to digital transformation.

Figure 2C provides a regional breakdown of maturity levels, showing that organizations with a global presence tend to consider themselves more advanced in their Pharma 4.0™ adoption. According to the data in Figure 2D, the maturity levels of Pharma 4.0™ adoption also appear to correlate with site dimension. Specifically, respondents from larger facilities and in corporate positions report more advanced stages of Pharma 4.0™ implementation compared to those from smaller sites. This suggests that larger organizations with greater resources and broader geographic oversight perceive themselves as having made more progress in adopting Pharma 4.0™, with a substantial proportion engaged in systematic ongoing actions.

The overall trend toward higher maturity levels across organizations of all dimensions indicates growing confidence and commitment within the industry toward digital transformation. However, it is notable that the proportion of projects in the pilot phase remains high and stagnant (see Figure 2A). This suggests that the industry faces challenges in transitioning from isolated Pharma 4.0™ experiments to broader adoption, which prevents the full potential benefits of digital transformation.

Figure 2: Maturity levels in Pharma 4.0™ adoption: (A) percentage of respondents at different stages of Pharma 4.0™ maturity from 2021 to 2023, (B) cumulative percentage of respondents in the less advanced and more advanced maturity level groups, (C) maturity levels by operating region, and (D) maturity levels by site dimensions.

SE: standard error; CI: confidence interval.

Enabling Technologies

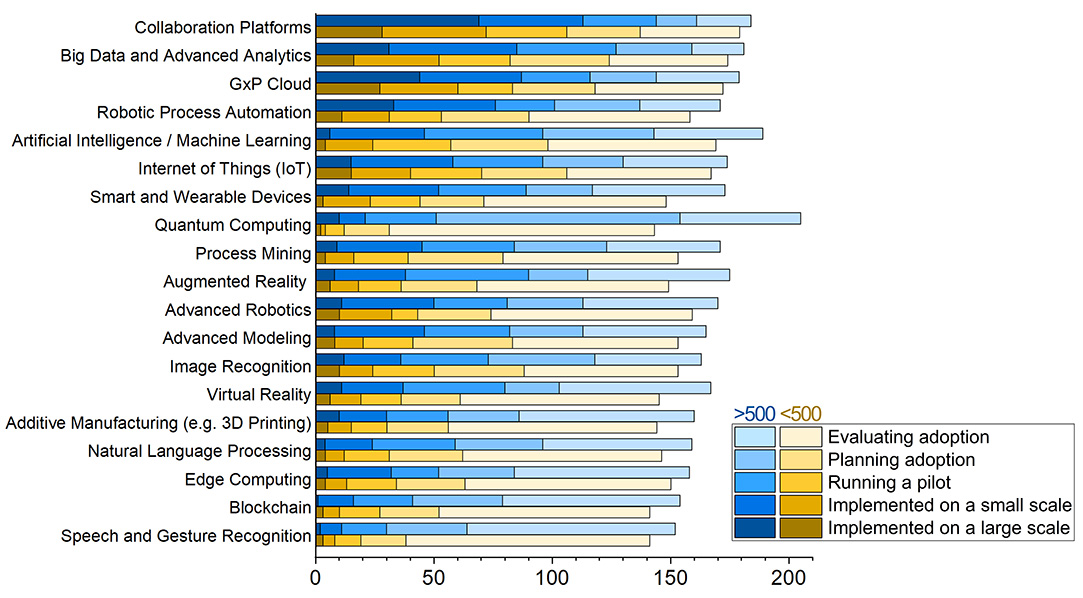

According to the ISPE Baseline Guide Vol 8: Pharma 4.0™, the survey examined a selection of 19 enabling technologies.1 These technologies were categorized into three distinct maturity groups:

- Well-adopted technologies that appear to be progressing more rapidly and on a larger scale (e.g., collaboration platforms, big data and advanced analytics, GxP cloud, IIoT, robotic process automation, AI/ML)

- Technologies that are adopted, but mainly on a small scale or in pilot stages (smart and wearable devices, augmented reality, process mining, advanced robotics, image recognition, advanced modeling, virtual reality, natural language processing, additive manufacturing)

- Less-adopted technologies, at least within the survey sample and sector (edge computing, blockchain, speech and gesture recognition, quantum computing)

Overall, all technologies exhibit similar levels of planning or evaluation across the industry (see Figure 3). This indicates extensive ongoing innovation and new business case exploration within the sector. Notably, AI and ML, despite being widely referenced, have yet to achieve significant large-scale implementation.

Figure 3 also compares technology adoption levels between larger and smaller pharmaceutical sites/organizations, revealing significant disparities in their overall adoption levels and technological focuses. Respondents from larger sites (defined here as those with over 500 employees) and corporate roles report higher adoption levels and rates for advanced technologies. The data indicate that technologies such as collaborative platforms, big data and advanced analytics, robotic process automation, IIoT, and AI/ML have been extensively implemented or are in advanced planning stages. Furthermore, large organizations often have the capabilities and resources to experiment with novel and/or sophisticated technologies, enabling them to pivot if projects do not yield expected results. This flexibility may accelerate innovation life cycles, leading to higher technology adoption rates.

Smaller sites, with fewer than 500 employees, seem to exhibit a more cautious approach to advanced technology adoption. As Figure 3 suggests, the adoption rates and levels are notably lower, particularly for more sophisticated technologies such as AI/ML or quantum computing. Smaller sites seem to predominantly focus on well-established technologies with a clear return on investment, such as collaborative platforms and GxP cloud systems. This strategic focus may allow them to maximize the benefits of digital tools while managing resource constraints effectively. The slower adoption pace for more sophisticated technologies suggests potential challenges in scaling efforts and achieving the same level of technological integration as their larger counterparts.

The comparison between larger and smaller sites/organizations highlights a divide within the pharmaceutical industry. Larger organizations, with their often more substantial resources and global reach, may be better positioned to adopt and benefit from advanced technologies on a large scale to accelerate their digital transformation journey. Small sites, on the other hand, may require targeted support and investment to overcome resource constraints and enhance their technology adoption capabilities. The specific drivers and challenges are further discussed next.

Figure 3: Enabling technology adoption levels by site dimension. Lighter colors indicate lower adoption levels, whereas more intense colors indicate higher levels of adoption. Blue colors represent larger sites (> 500 employees) and corporate representative; yellow colors represent smaller site representatives (< 500 employees).

Digital Transformation Benefits

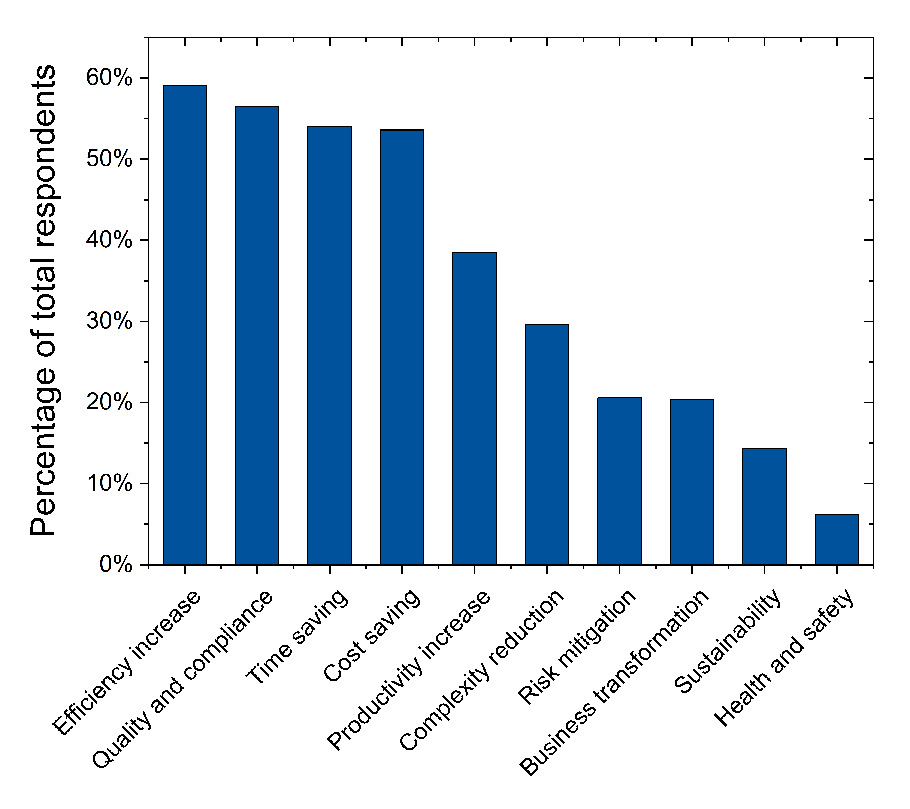

Figure 4 illustrates the perceived benefits of Pharma 4.0™ programs as reported by the survey participants. The most frequently cited benefit was increased efficiency, recognized by nearly 60% of respondents. Quality- and compliance-related benefits followed closely, with 56.5% acknowledging them as key drivers. The high frequency of recognition for quality and compliance improvements underscores the positive impact of digitalization on product quality and patient safety. Time and cost savings were also significant benefits, each identified by over 50% of participants.

Productivity increase and complexity reduction were notable drivers as well, reported by 38.5% and 29.7% of respondents, respectively. Risk mitigation and business transformation were cited by more than 20% of participants, and sustainability was mentioned by over 14%, reflecting awareness of the broader impacts of Pharma 4.0™ initiatives. Health and safety improvements are less frequently noted with only 6.2%. Few geographical differences were observed, although sustainability was more pronounced in North America, and quality and compliance benefits were cited more in Europe. However, no significant differences were found comparing different site dimensions.

These results demonstrate a broad understanding of the diverse benefits of Pharma 4.0™ across various organizational scales, departments, and geographical locations. They reflect a wide commitment to leveraging digital transformation to enhance efficiency, quality, regulatory compliance, and overall operational excellence within the pharmaceutical industry.

Figure 4: Perceived benefits of Pharma 4.0™ programs as the percentages of the total number of respondents (n = 418); the respondents were asked to choose a maximum of four options.

Digital Transformation Challenges

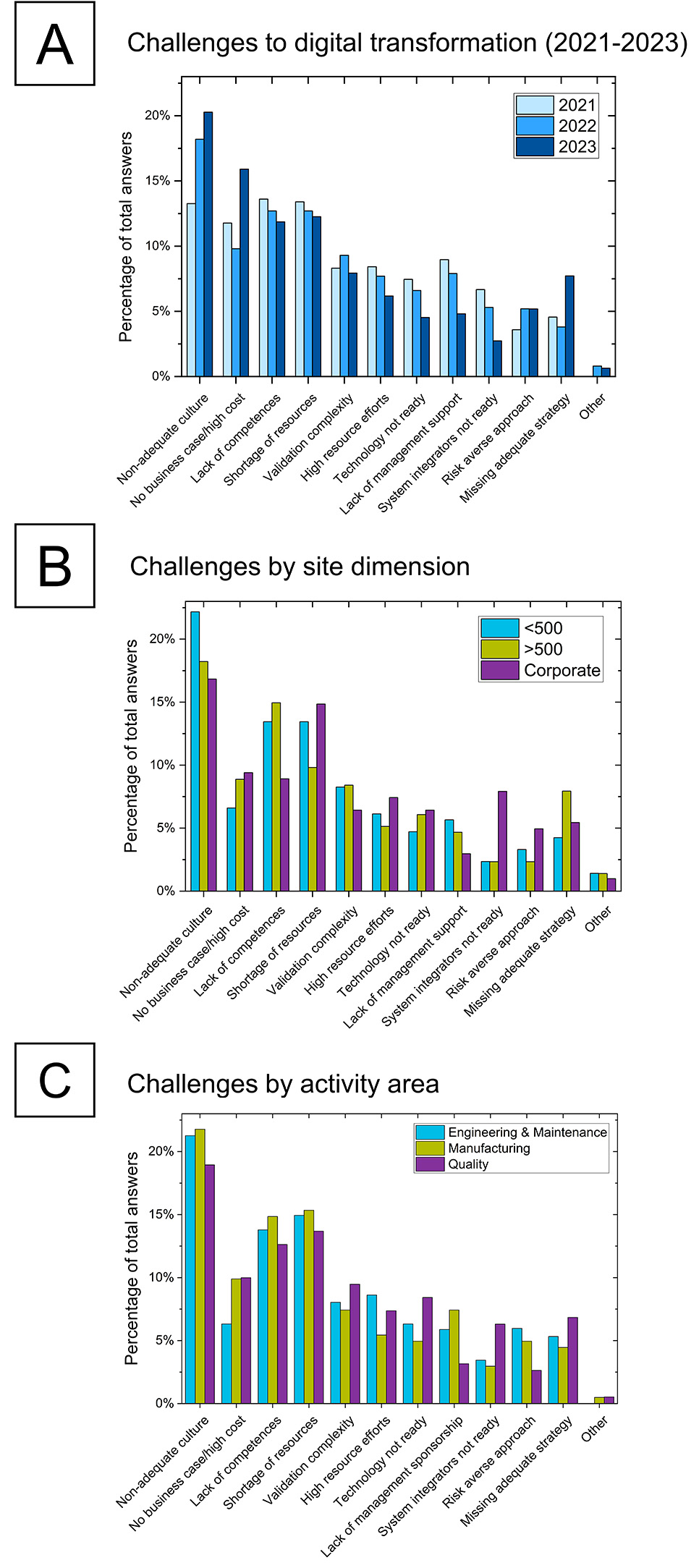

Digital transformation necessitates and drives significant shifts in companies’ operations. It demands substantial changes in culture and mindset to sustainably incorporate advanced technologies. This transformation is accompanied by various barriers and challenges. Understanding those early in the process can help anticipate common problems and find proper solutions and mitigation strategies faster. The graphs presented in Figure 5 provide a detailed analysis of the complex barriers organizations face when implementing their Pharma 4.0™ initiatives. The challenges vary over time (5A), by site dimension (5B), and across different departments (5C). This will be discussed in more detail in the following paragraphs.

Cultural resistance remains the most significantly increasing barrier, underscoring the need for proper change management and the cultivation of a supportive organizational environment. Increasing financial concerns and the need for well-developed business cases have become more pronounced, which emphasizes the importance of clearly demonstrating the return on investment to justify initiatives. Smaller sites struggle more with resource availability and skills, and larger entities face strategic and competence-related challenges. Smaller sites therefore may benefit from enhanced training and resource management, whereas larger ones might focus on simplifying validation processes and better aligning their extensive operations with digital transformation goals. Different departments also experience some unique barriers, with engineering and maintenance being cautious about resources and risks, manufacturing requiring more competences and managerial support, and quality struggling with validation and the perception of technology readiness. By understanding and addressing these diverse challenges, organizations can more effectively navigate the complexities of their Pharma 4.0™ programs. The following paragraphs delve more deeply into the details of the challenges perceived by those different groups.

Figure 5: Challenges to Pharma 4.0™ programs in the pharmaceutical industry (A) over time, (B) by site/organization dimension, and (C) by activity area.

Over Time

Figure 5A shows the evolution of perceived challenges from 2021 to 2023. One of the most striking trends over these years is the steep increase in the perception of “non-adequate culture” as a barrier. This rise indicates a growing recognition of the importance of organizational culture in the successful implementation of digitalization initiatives. As companies advance in their Pharma 4.0™ journeys, the lack of a supportive and adaptable culture becomes more apparent. This underscores that comprehensive cultural and mindset transformations are required alongside technological advancements.

Another notable trend is the sharp increase in the perception of “no business case/high cost” as a barrier. This increase, particularly noticeable in 2023, suggests growing concerns about the financial justification and cost associated with digital transformation. The rising costs and the challenge of demonstrating clear, tangible benefits may deter companies from fully committing to these initiatives. Although the trend needs to be confirmed in subsequent surveys, it highlights the importance of developing strong business cases as well as clearly defining the problem statement and the expected outcomes to support digital initiatives and ensure their adequate financial viability and organizational sponsorship.

Conversely, the challenge of “lack of top management support” has shown a consistent decrease over three years. This trend is encouraging, indicating that more organizations are securing the backing of senior leadership and of organizational commitment for their digital transformation efforts. However, the significant simultaneous increase in “missing adequate strategy” suggests a growing recognition that without a well-defined strategy and related roadmaps, digital transformation efforts are more likely to fail. Organization representatives are increasingly aware of the need for comprehensive planning and strategic alignment to guide their Pharma 4.0™ initiatives.

Site Dimension

Figure 5B delves deeper into how these barriers are perceived differently depending on the dimension of the site/organization. Smaller sites with fewer than 500 employees more frequently report “non-adequate culture,” “shortage of resources,” and “lack of competences.” Notably, these companies see “system integrators not ready” as a less significant barrier. This may be due to smaller companies often having less maturity (see Figure 2D) and financial capabilities to properly select and manage adequate system integrators and technology providers for complex projects. Consequently, they may perceive issues primarily originating from external sources. In contrast, larger sites, of more than 500 employees, more frequently cite “lack of competences” and “lack of adequate strategy” as concerns. These organizations, dealing with highly complex and large-scale operations, emphasize the need for skilled personnel and well-defined strategic plans. “Shortage of resources” is a less significant challenge for larger entities, suggesting that they may have better resource availability compared to smaller sites. This results in different technological focuses, as previously discussed.

At the corporate level, challenges such as “shortage of resources,” “no business case/high cost,” and “system integrators not ready” were named more frequently compared to the other two groups. These individuals often manage extensive operations and strategic initiatives, which could explain the heightened awareness of resource constraints and financial justifications. The lower reported prevalence of “lack of competences” and “lack of management support” as barriers at the corporate level may suggest a potential bias, as these entities are often the managing bodies and may not have complete visibility into the challenges faced at the local site level.

Activity Area

Figure 5C explores the challenges from a departmental perspective, revealing how specific barriers impact various parts of an organization differently. The three activity areas with the highest representation in the survey sample were chosen for the comparative analysis, namely engineering and maintenance, manufacturing, and quality assurance. The engineering and maintenance departments report “risk-averse approach” as a more significant challenge compared to the manufacturing and quality departments and “no business case/high cost” and “system integrators not yet ready” as less significant barriers. This indicates that engineering teams may be particularly cautious about adopting new technologies, possibly due to the potential risks involved in retrofitting these into existing physical systems.

In the manufacturing departments, “lack of competences” and “lack of management sponsorship” are reported more frequently, which suggests a critical need for skill development and stronger managerial backing to support digital transformation initiatives. On the other hand, “system integrators not ready” and “high resource efforts” are seen as less significant barriers, indicating that manufacturing teams may feel more confident in their existing integration and resource management practices.

Quality departments face several major challenges, including “no business case/high cost,” “validation complexity,” “technology not ready,” and “system integrators not ready.” These barriers highlight the stringent operating environments for quality assurance and the difficulties in validating and integrating new technologies. Conversely, “lack of management support” and “risk-averse approach” are less significant barriers, suggesting that quality teams might often experience sufficient managerial backing and are more open to taking calculated risks.

Looking Ahead

A wide array of technological advancements and process optimizations aimed at enhancing operational efficiency, regulatory compliance, and overall productivity within the industry were reported in the “future projects” section of the survey. The most frequently named application areas and their anticipated impacts are summarized next. A prominent focus area, considering the survey sample was composed of approximately 50% manufacturing and engineering respondents, is the implementation of manufacturing execution systems (MES) and electronic batch recording (EBR) systems, including manufacturing operations management. These systems aim to increase overall process automation and innovation, reduce human error, and enable seamless and predictive traceability and analysis. This ultimately facilitates better quality and faster product delivery. Over the next years, these systems are expected to reach a level of widespread adoption within the life sciences industry, fully integrating manufacturing execution-level operations with enterprisewide systems such as enterprise resource planning (ERP), electronic quality management systems (eQMS), and laboratory information management systems (LIMS).

The survey respondents also highlighted the implementation and integration of electronic quality management systems across the life sciences value chain as another important priority area. The aim is to develop more cloud-based quality management systems that can serve enterprise wide and multi-compliance needs in various regulated domains (GxP and ISO). This is expected to enhance data quality and security, ultimately leading to improved regulatory compliance, cost efficiency, and agility of pharmaceutical quality organizations.

Another key focus for our survey sample was LIMS which aims to ensure consistency and efficiency in quality control laboratory operations, as well as fully support the transition to a paperless environment. A significant number of shared projects originated from engineering functions focused on integrating equipment and automation with supervisory control and data acquisition (SCADA) and integration layers applications. Additionally, these projects involved adding layers to enable the calculation of overall equipment effectiveness (OEE) and fully integrate higher-level applications such as MES and electronic batch record. These projects focus on enhancing data integration and real-time communication across systems, with the goal of optimizing operations, improving data quality, and reducing resource and energy consumption within controlled environments. A significant number of predictive asset maintenance initiatives were also highlighted, targeting the simplification of GMP facility commissioning and operational management. These initiatives aim to improve accuracy, reduce time and costs, and leverage data more effectively through an increasingly predictive approach.

Notable initiatives also include the adoption of robotic process automation (RPA) and warehouse automation technologies, which can reduce manual processing times, enhance compliance, and allow employees to focus on higher-value activities. Advanced process modeling aims to create adaptive and optimal control strategies that minimize subjectivity in decision-making and support continual improvement. Additionally, the deployment of AI-based vision systems for machinery troubleshooting and the adoption of digital twins for virtual space utilization represent forward-thinking approaches to operational challenges.

Conclusion

The 7th ISPE Pharma 4.0™ survey, a collaborative effort by the Management Communication Strategy working group of the ISPE Pharma 4.0™ Community of Practice, provides a broad perspective on the pharmaceutical industry’s digital transformation journey. The adoption of advanced technologies and the integration of digital ecosystems have become central to enhancing manufacturing, supply chain, and business processes. The survey highlights a significant movement toward higher maturity levels in Pharma 4.0™ adoption, with many organizations progressing from initial planning stages to implementing pilots and even systematic ongoing actions.

The demographic analysis reveals a diverse and balanced representation of respondents, predominantly from Europe and North America, but also including significant input from Asia Pacific and other regions. This widespread participation ensures a well-rounded perspective on the industry. Maturity levels indicate a positive trend toward more advanced stages of digital adoption, with larger and globally operating organizations leading the way. The level of adoption of innovative enabling technologies is more prevalent in larger entities, whereas smaller sites focus on established technologies with clear returns on investment.

The benefits of Pharma 4.0™ are evident, with increased efficiency, quality, and compliance being the most frequently cited advantages. However, the transition is not without challenges, including cultural resistance, financial justification, and the need for a robust strategy as significant barriers that organizations must overcome. Smaller sites particularly struggle with resource constraints, whereas larger organizations face strategic and competence-related challenges.

Future projects highlighted in the survey point toward continued advancements mainly in MES/EBR, eQMS, LIMS, and predictive maintenance digital applications. These initiatives aim to create a more integrated, efficient, agile, and compliant industry capable of meeting the ever-changing demands of modern pharmaceutical development, manufacturing, and distribution.

As we look ahead to the release of the results of the 8th ISPE Pharma 4.0™ survey at the end of 2024, we anticipate continued progress in Pharma 4.0™ maturity across the industry. The upcoming survey will continue to monitor the progression of digital maturity in terms of implemented technologies, associated benefits, and obstacles. It will also introduce a focus on cybersecurity considerations and prevalent technical pitfalls to be aware of when undertaking Pharma 4.0™ initiatives.

As digital technologies and the work of production line operators become increasingly integrated into pharmaceutical operations and management, the security, integrity, and availability of the data and systems they rely on will be crucial. The 2024 edition results will offer detailed insights into how organizations are addressing cyberthreats and protecting their digital assets. Building on a robust yet growing foundation of 418 respondents from 45 countries in 2023, we expect the next survey to provide even more granular and actionable data to support the entire industrial ecosystem in their ongoing digital transformation journey. The ISPE Pharma 4.0™ survey will continue to be a vital resource for a wide range of stakeholders, from industry professionals to academics and regulators, as they navigate and guide the evolving pharmaceutical landscape.2

About the Authors

Acknowledgements

The analysis of the survey was a collaborative effort, drawing contributions from Alberto Augeri from LifeBee, a ProductLife Group company, as well as Robin Schiemer from Karlsruhe Institute of Technology (KIT).