Knowledge Management Implementation: A Survey of the Biopharmaceutical Industry

Knowledge management (KM) has been a recognized discipline for over 20 years in other industries, although within the biopharmaceutical industry, its discussion and formal implementation have been slow to gain momentum. The topic gained regulatory significance in 2008 when the ICH guidance document Pharmaceutical Quality System: Q10 included knowledge management as a key enabler of a pharmaceutical quality system (PQS).1 Despite this, a broad understanding of knowledge management and its implementation in the pharmaceutical industry has not been widely explored or benchmarked to date. The authors offer the research discussed in this article as a baseline for future comparisons for knowledge management implementation within the pharmaceutical industry and across other industry sectors.

- 1International Conference on Harmonisation of Technical Requirements for Registration of Pharmaceuticals for Human Use. “Pharmaceutical Quality System: Q10.” 4 June 2008. http://www.ich.org/fileadmin/Public_Web_Site/ICH_Products/Guidelines/Quality/Q10/Step4/Q10_Guideline.pdf

This article describes the results of a survey focused on knowledge management in the pharmaceutical industry. Responses suggest a low level of knowledge management maturity compared to other industries. This article also outlines further opportunities to explore knowledge management practices and approaches in the biopharmaceutical industry. (For the purposes of this article, “biopharmaceutical industry” incorporates the life cycle of medical devices and medicinal products, including chemical and biological entities, from discovery to patient delivery.)

With the release of Pharmaceutical Quality System: Q10 in 2008, knowledge management, together with quality risk management (QRM), were formally identified as key enablers of an effective pharmaceutical quality system. Although knowledge management has been recognized as a discipline for over 20 years,2 adoption within the pharmaceutical industry has been slow.3 As an example, quality risk management, identified as important simultaneously with knowledge management, already benefits from a guidance document of its own (ICH Q9).4

The pharmaceutical regulatory environment drives a high level of documentation that could be described as “explicit knowledge.” Focusing solely on explicit knowledge, however, may not enable the organization to fully leverage its collective knowledge and meet its business objectives. With the advancement of new technology platforms, an increasing trend to outsource manufacturing, and competition from generics and biosimilars, the complexity and the need for “know-how,” or “tacit knowledge,” is also increasing.5 ,6

Effective Knowledge Management

Although the pharmaceutical industry has deep knowledge of its products and processes, stronger knowledge management could help the industry better help patients by limiting mistakes, providing greater speed to market, delivering continuous product improvement, and offering uninterrupted supply, all at lower cost. Effective knowledge management has also been identified as competitive advantage.7 ,8

The survey findings compare other knowledge management approaches in other industries, with a view to answering the following:

- How does the pharmaceutical industry “do” knowledge management?

- How well does this approach to knowledge management compare to those of other industries?

Background

A detailed literature review explored multiple knowledge management benchmarking maturity models and surveys. Two key surveys were considered when designing this research: the Knoco Global knowledge management Survey9 ,10 and the American Productivity and Quality Center (APQC) Knowledge Management Priority Survey.11 The Knoco survey was initially administered in 2014 and repeated in 2017. It is industry-agnostic with no specific pharmaceutical category. There were 369 survey respondents in 2014 and 417 in 2017 (a 13% increase). In 2015, American productivity and quality center developed the Knowledge Management Priority Survey,11 focused specifically on American productivity and quality center members, with 523 respondents.

In addition to focusing the benchmarking exercise on the biopharmaceutical sector, pharmaceutical industry–specific questions were prepared by the research team in consultation with the ISPE Knowledge Management Team. (The ISPE Knowledge Management Team was a subset of the ISPE Product Quality Lifecycle Implementation [PQLI®] Technical Team.) In 2017, the ISPE Product Quality Lifecycle Implementation Knowledge Management Team collaborated with the Technological University Dublin Pharmaceutical Regulatory Science Team (PRST) Research Team to identify a small number of industry-specific questions, primarily relating to ICH Q10 and current knowledge of the then-forthcoming draft of ICH Q12,12 which were included in the research.

Research Methodology

The survey was designed to explore the following areas of knowledge management: demographics, resources and team structure, scope and business drivers, implementation and change management, processes, priorities, and pharmaceutical-related topics.

To facilitate comparative analysis, survey questions were designed to be quantitative where possible. In most cases, questions were used verbatim from the American productivity and quality center and Knoco surveys. Changes made were typically additions and were noted.

In advance of survey design, the researchers held a philosophical dialogue with Knoco and American productivity and quality center leaders to discuss the research plan, ensure understanding of the respective survey designs, and seek partnership in aligning survey responses. Both organizations provided a full listing of questions as well as response choices. This enabled the researchers to compare responses from the pharmaceutical-specific survey with other industries, and thus obtain a meaningful benchmark.

American productivity and quality center survey design experts reviewed the survey to ensure clarity and flow, and that the design met the research objectives. The survey was created in SurveyMonkey and tested by the ISPE Product Quality Lifecycle Implementation Knowledge Management Team in review mode. The survey launched 1 August 2017 and remained open until 30 September 2017. The survey was publicized to the pharmaceutical industry via the ISPE Product Quality Lifecycle Implementation Knowledge Management Team and their respective personal networks, ISPE Knowledge Network and related Communities of Practice (CoPs), and LinkedIn groups frequented by pharmaceutical industry personnel with interest or experience in knowledge management.

Survey respondents were given the survey background. To align with the Knoco survey, however, no formal knowledge management definition was provided. Instead, respondents were asked to answer based on usage of the term within their organizations, and to share the names of their organizations to determine if there were multiple responses from the same organization. This aligned with the Knoco and American productivity and quality center methodologies. Organization names remained confidential and were blinded in all data reporting.

The first group of questions was designed to discern respondent demographics and organizations and to explore how thoroughly knowledge management had been adopted within those organizations. Other questions explored the size of the knowledge management team, reporting structures, roles, and audience of knowledge management initiatives, as well as implementation methodologies, barriers, metrics, processes, and priorities. The survey concluded with questions focused on pharmaceutical regulatory guidance related to knowledge management and management of prior knowledge, specifically ICH Q10 and the Q12 draft. (The ICH Q12 Draft for Industry Consideration had not been publicly released when the survey was conducted; however, considerable discussion had been ongoing in industry.)

Twenty-five respondents from the pharmaceutical industry participated, representing 20 unique organizations (e.g., companies or heath authorities). This low response rate may signal a low level of understanding and implementation of knowledge management in the pharmaceutical industry. In contrast, a 2015 survey of quality risk management (the partner enabler in ICH Q10) elicited over 150 responses from pharmaceutical industry respondents.13

Survey responses were anonymized and analyzed. A full analysis of all survey data was conducted and benchmarked against the Knoco and American productivity and quality center survey findings. Due to the small sample size, however, subanalyses within the pharmaceutical data group (n = 20) were not pursued; future surveys with a larger data set could yield new insights. Key findings from the survey were presented at the ISPE Annual Meeting in October 2017.

Results and Discussion

Demographics

Initial questions focused on demographics, organization type, respondent role, functional area in which the respondent worked, organization size, current status of knowledge management in the organization, global regions within the knowledge management program scope, and how long the organization had been “doing” knowledge management. Only the demographics questions were mandatory, as it was recognized that organizations could be at varying levels of knowledge management understanding or implementation. In the context of survey participation (n = 25), just over half of respondents (n = 13) provided full responses; the remainder provided partial responses.

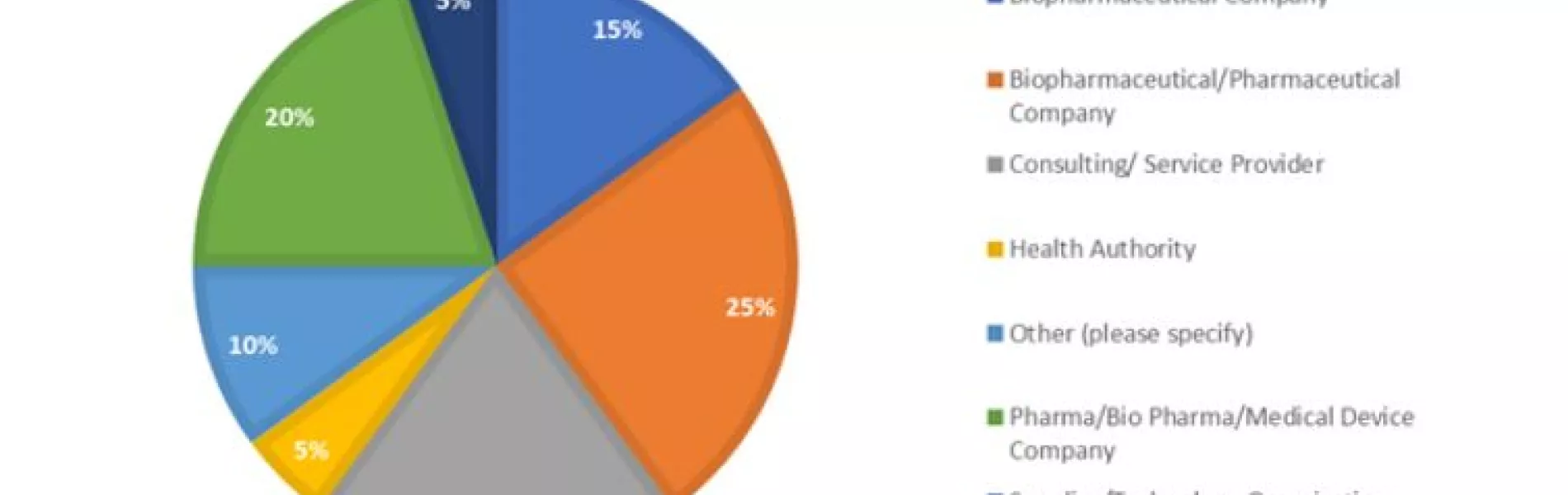

Organizational demographics are presented in Figure 1.

Figure 1. Organization demographics of survey respondents; n = 25, with 20 unique organizations.

Demographic information indicated a diverse organizational background. Sixty percent of the organizations were pharmaceutical; medical device manufacturers comprised the largest cohort of survey participants.

When asked to describe their roles, 44% of respondents were either leading a knowledge management initiative within their organizations or had a full-time knowledge management role, compared to 73% in the 2017 Knoco survey. An additional 16% had a knowledge management role, but not a full-time commitment, compared to 18% in the Knoco survey. Forty percent had no specific knowledge management role or were consultants, compared to 9% reported by Knoco. Table 1 shows the functional diversity and knowledge management activity of the organizations represented.

| Functional organization | Knowledge management activity, % |

|---|---|

| Quality assurance/quality control | 24 |

| Research and development | 24 |

| Technical operations | 16 |

| Regulatory affairs | 12 |

| Commercial manufacturing | 8 |

| Information technology | 8 |

| Clinical supplies manufacturing | 4 |

| Other (reported: human resources) | 4 |

The primary geographic regions of focus for knowledge management activity were in North America and Europe (18 and 17 respondents, respectively), followed by the Asia Pacific region (5) and the Middle East/Africa and South America (3).

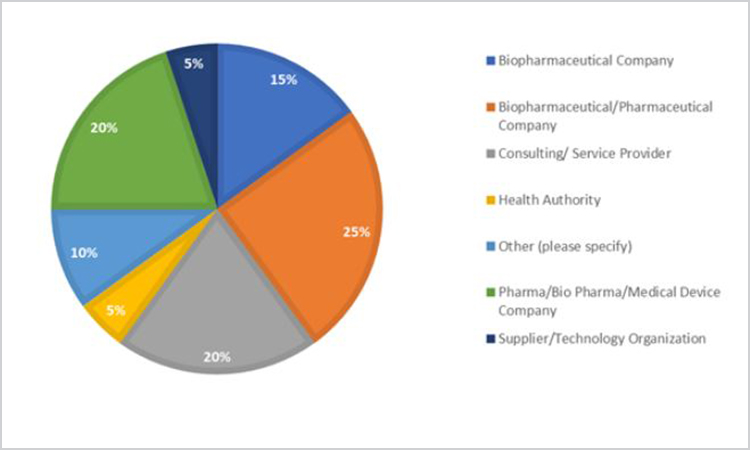

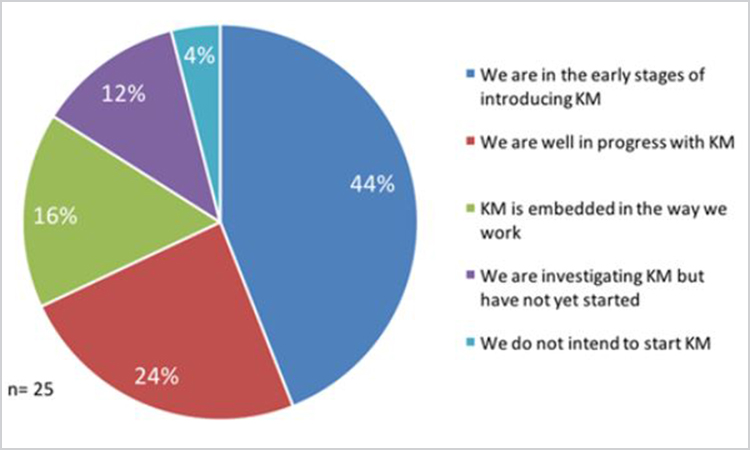

When asked about the status of knowledge management in their organizations, 56% were either investigating or in the early stages of introducing knowledge management. Twenty-four percent reported they were well in progress with knowledge management, and 16% reported that knowledge management is embedded in the way they work. Only 4% of respondents expressed no intention of starting knowledge management (Figure 2).

Figure 2. Status of knowledge management in the organization (n = 25).

The reported status of knowledge management and number of respondents with knowledge management leadership/full-time roles in the pharmaceutical industry (44% vs 73% per the Knoco survey for other industries), when combined with the 25% of respondents who reported knowledge management is embedded in the way they work, sheds some light on the general status of knowledge management in the pharmaceutical industry.

Resources and Team Structure

The second group of questions explored the extent of resources and reporting structure allocated to knowledge management within organizations. Nearly half of the respondents (48%) reported a knowledge management team size of 0–2 people; 32% reported 4–8, 12% reported 12–20, and 0 respondents reported over 20 people. Eight percent of respondents did not know the size of the knowledge management team. Table 2 compares responses from this survey to findings in the 2017 Knoco survey.

| Team Size | Pharmaceutical, % (n = 25) | Knoco, %(n = 335) |

|---|---|---|

| Unknown | 8 | 18 |

| 0–2 | 48 | 28 |

| 4–8 | 32 | 34 |

| 12–20 | 12 | 12 |

| 20+ | 0 | 7 |

Although the sample sizes differ significantly, it is notable that Knoco reported the team mode size of 4, whereas the pharmaceutical data reflect a mode size of 0–2.

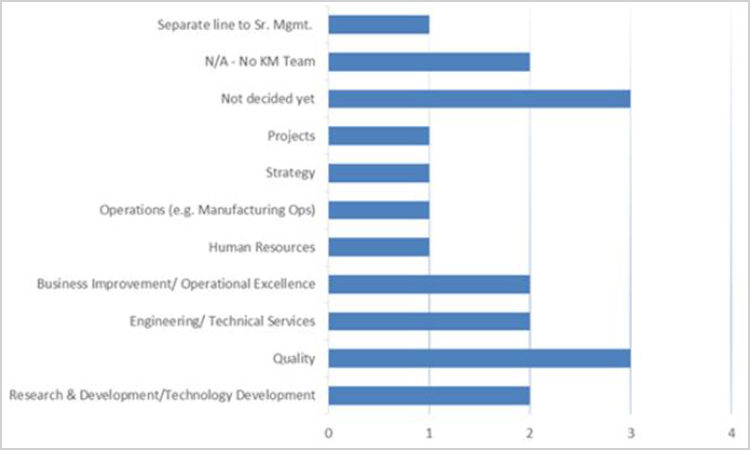

When asked about the reporting structure of the knowledge management team, the majority of respondents (43%) reported to an individual (a traditional structure), 24% reported to a committee, and 5% indicated the team was either self-steering or reported to an individual supported by a steering committee. When asked about reporting departments, no clear patterns emerged. Figure 3 outlines the departments to which knowledge management initiatives report.

Figure 3. knowledge management initiative reporting departments (n = 21).

The most common knowledge management role reported was a community of practice (CoP) leader (6 respondents). This was closely followed by knowledge management for a department or division, owner for a specific knowledge project and content management support (4 respondents each). Other reported roles were a community of practice facilitator and a knowledge management champion/coach (2 respondents each). Knoco surveys reported the top four knowledge management roles as knowledge management technology support, content management support, owner of a specific knowledge topic, and community of practice leader.

Knowledge management Scope and Business Drivers

Because ICH Q10, which illustrates the pharmaceutical product life cycle, and identifies knowledge management as an enabler for the pharmaceutical quality system, the research team was keen to understand the scope of current knowledge management initiatives represented by functional areas that support life-cycle activities. They also hoped to gain insight into business drivers and prioritization.

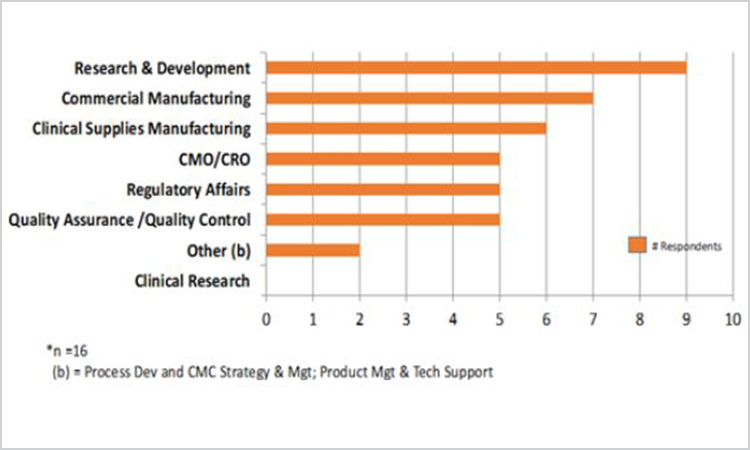

Looking first at the scope of knowledge management activities, half of the respondents indicated their knowledge management initiatives were focused on one division, business stream, or region (n = 16). Nineteen percent reported the scope extended to the entire organization, whereas 6% reported multiple regions or divisions. In addition, some organizations focus on one pilot area (13%), whereas others have not determined the knowledge management scope (6%). Figure 4 shows the scope of knowledge management initiatives.

Figure 4. Functions in scope of knowledge management initiative (n = 16)

Comparing these responses to the ICH life-cycle stages shows that knowledge management initiatives and programs span pharmaceutical development, technology transfer, and commercial manufacturing life-cycle elements. It is worth noting, however, that there is no evidence of knowledge management at the clinical research stage of a pharmaceutical product, perhaps due to the demographics of the survey respondents. It would be useful to survey focusing specifically on the clinical research stage in the future.

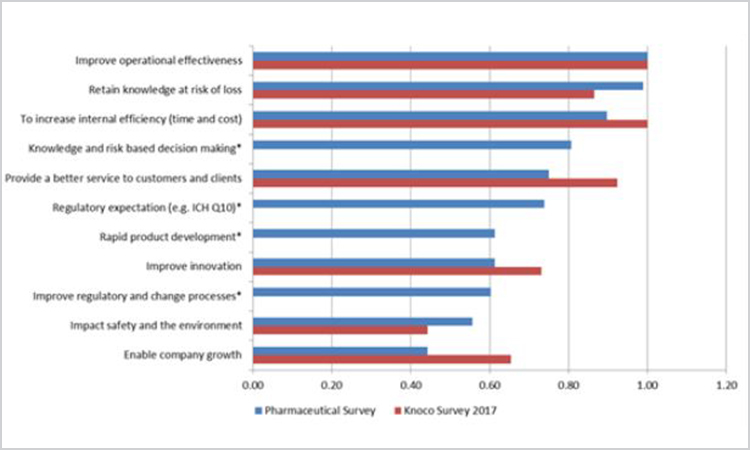

Figure 5 presents the business drivers from both surveys. Questions from the 2017 Knoco survey were supplemented with four additional selections of particular interest to the pharmaceutical regulatory environment; these are marked in the figure with an asterisk (*). Where necessary, here and throughout, all data have been normalized to the highest reported result for each survey to preserve further quantitative comparison and to illustrate relative importance within a data set and rank order across surveys.

Figure 5. Comparison of pharmaceutical and 2017 Knoco survey knowledge management business drivers (n = 15) (*indicates areas that are of specific interest to the pharmaceutical sector and not represented in the Knoco survey).

The top driver in both surveys was “improve operational effectiveness,” indicating that knowledge management is important regardless of industry. Significantly, the selections added to highlight anticipated pharmaceutical drivers all ranked in the middle of the responses. Although none emerged as a clear top driver, neither were they ignored. These questions were used to gauge links to key concepts in ICH Q10 (and the then-forthcoming ICH Q12) about leveraging product knowledge to achieve product realization.

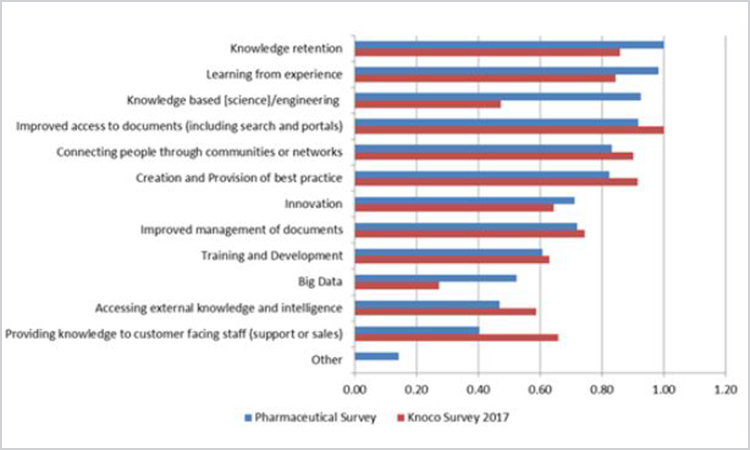

Questions around how knowledge management approaches are prioritized and implemented (Figure 6) were taken from the 2017 Knoco survey. Due to the scientific nature of pharmaceutical product development, however, one question on “knowledge-based engineering” was modified to include “science” in the response selections.

Figure 6. Comparison of knowledge management Approaches—pharmaceutical and Knoco 2017 surveys (n = 15).

The top priority in the pharmaceutical survey was “knowledge retention,” which contrasts with improved access to documents in the 2017 Knoco survey. This is not surprising, given the clear direction of ICH Q8–Q10 to utilize prior knowledge. Interestingly, the 2014 Knoco survey data showed that “connecting people through communities or networks” was the highest priority, followed by “learning from experience,” and then “improved access to documents” (the top 2017 priority). Also of note: The top two priorities for pharma (“knowledge retention” and “learning from experience”) focus on tacit rather than explicit knowledge. This correlates with earlier survey responses in which the most common roles appear more biased toward tacit knowledge (i.e., CoP leader).

Implementation and Change Management

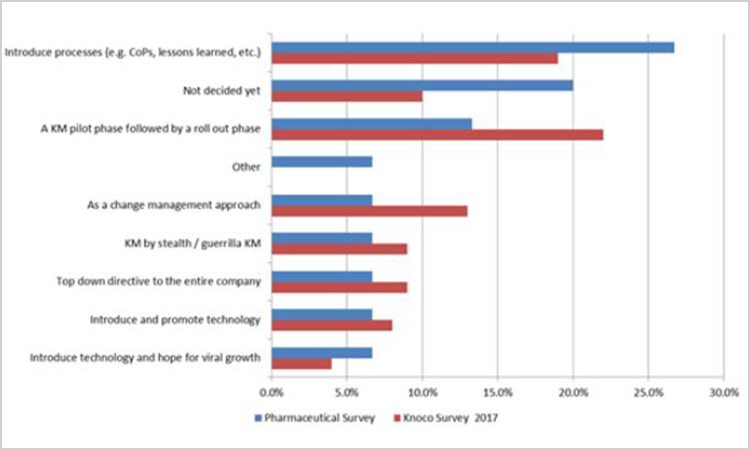

Participants were asked how their organizations implemented knowledge management. These questions corresponded with those from the Knoco 2017 survey; responses are summarized in Figure 7.

Figure 7. Survey Question: “How has knowledge management been implemented in your organization?” (n = 14)

In general, the data reported in the pharmaceutical study align well with the Knoco study. One key difference, however, is that 20% of pharmaceutical survey respondents indicated their organizations had not decided how knowledge management would be implemented, in contrast to only 4% in 2014 and 10% in 2017 for the Knoco surveys. Coupled with previous responses in which a significant percentage did not yet know where knowledge management would report or there was no knowledge management team (± 20% together), this suggests work that needs to be done in the pharmaceutical industry to best position knowledge management for success.

Another observation on this response is that the pharmaceutical respondents appear more likely to introduce processes (26.7%) than implement pilots and roll out phases (13.3%). Knoco responses indicate the opposite: People were more likely to conduct pilot (22.0%) than introduce a process (19.0%).

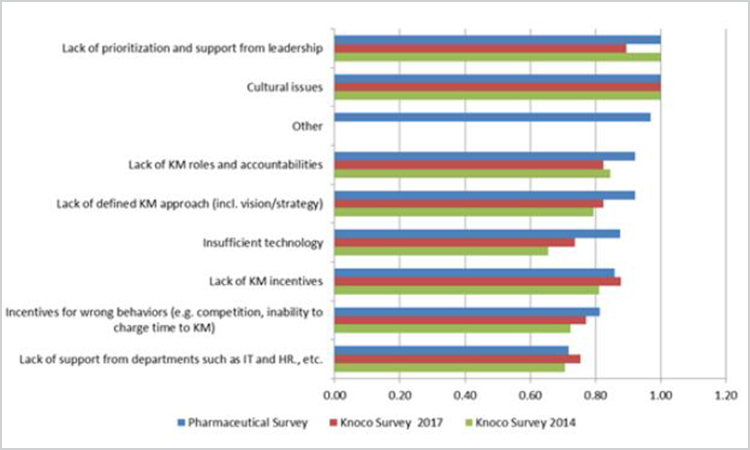

In addition, this section explored barriers to knowledge management implementation. Data from the 2017 and 2014 Knoco surveys were compared to the pharmaceutical survey to further enhance understanding of differences or similarities (Figure 8).

Figure 8. Barriers to knowledge management implementation—pharmaceutical, 2014 Knoco, and 2017 Knoco surveys (n = 14).

“Lack of prioritization and support from leadership” and “cultural issues” were the shared top barrier for the pharmaceutical and 2014 Knoco surveys, whereas the 2017 Knoco survey listed “cultural issues” as the top barrier. Perhaps this indicates focused prioritization, and leadership could lead to substantial improvements in knowledge management and associated maturity. The pharmaceutical survey also signals “lack of knowledge management roles and accountabilities” and “lack of defined knowledge management approach: as barriers more strongly than either Knoco survey, suggesting additional focus areas for improvement in pharma.

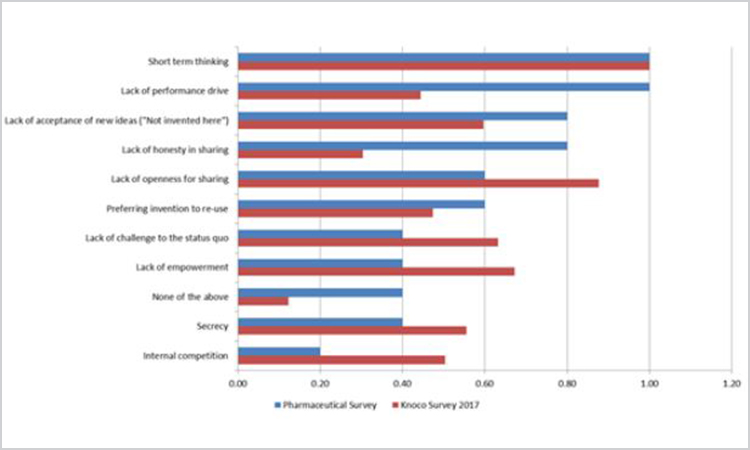

An additional question on knowledge management implementation explored cultural issues proven to be barriers to respondents’ knowledge management initiatives (Figure 9).

Figure 9. Cultural issues that have been barriers to knowledge management initiatives (n =14).

Short-term thinking was reported as a top cultural barrier in both surveys, with “lack of performance drive” receiving an equal number of responses in the pharmaceutical survey. However, it is worth noting that in the 2017 Knoco survey “lack of performance drive” was the second-to-the-last barrier identified, indicating that perhaps as organizations mature in knowledge management, so does their knowledge management performance drive.

Knowledge management Processes

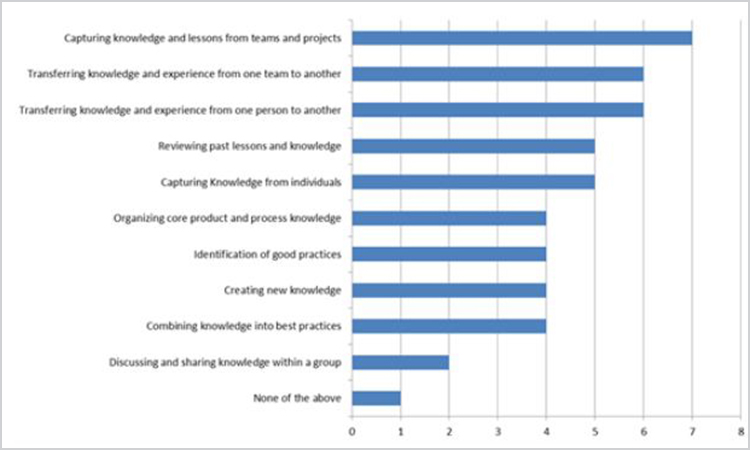

The next set of questions focused on knowledge management processes, beginning with the range of use of defined knowledge management processes (Figure 10).

Figure 10. Survey Question: “For which of these purposes do you use a defined process as part of your knowledge management program?” (n = 13).

It is interesting that “discussing and sharing knowledge within a group” had one of the lowest responses, perhaps as a result of the low value the pharmaceutical industry puts on tacit knowledge.

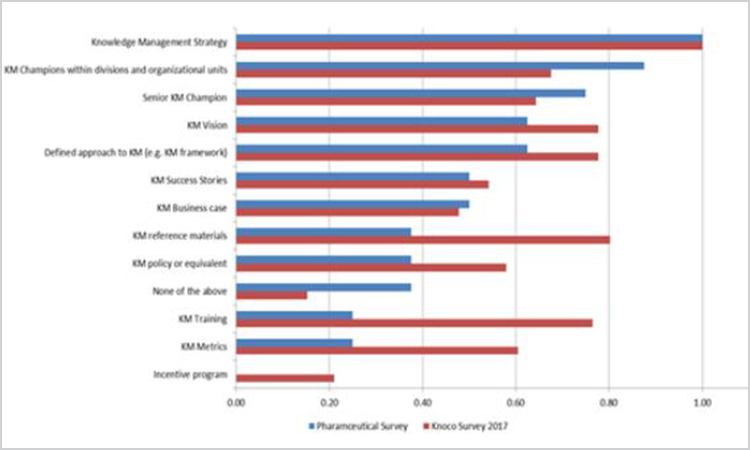

To provide insight into specific governance elements, participants were asked which standard knowledge management governance elements were currently in place in their organizations (Figure 11).

Figure 11. Survey Question: “Which of the following are currently in place in your organization, as far as you know?” (n = 13).

For both the pharmaceutical and 2017 Knoco surveys, “knowledge management strategy” was the highest governance element reported, with the pharmaceutical industry reporting “Knowledge management champions within divisions and organizational units” as next highest, perhaps indicating a reliance on individuals to drive knowledge management forward. In contrast, for the Knoco responses, “Knowledge management reference materials” and “Knowledge management training” ranked much higher in order of preference, indicating a higher level of maturity, and potential areas of opportunity the pharmaceutical industry could explore to help embed knowledge management.

Knowledge management Priorities

The next series of questions focused on priorities for the organizations’ knowledge management agendas. As in the preceding section, baseline questions were replicated from the 2015 American productivity and quality center member survey, with some specific sector questions added to the pharmaceutical survey.

The first question in this section focused on the importance of knowledge management priorities; Table 3 lists those indicated in the pharmaceutical survey, as “very important” and “important.”

| Knowledge management Priorities Listed as “Very Important” | Reported % | Knowledge management Priorities Listed as “Important” | Reported % |

|---|---|---|---|

| Promoting a knowledge-sharing culture | 46.2% | Capturing content and explicit knowledge | 69.2% |

| Improving content management, infrastructure, and search | 46.2% | Improving content management, infrastructure, and search | 46.2% |

| Enabling sharing and collaboration within and across teams/units | 38.5% | Eliciting and transferring tacit knowledge | 46.2% |

| Developing a knowledge management strategy | 38.5% | Increasing engagement in knowledge management tools and approaches | 38.5% |

| Increasing the maturity of the knowledge management program/effort | 23.1% | Enabling sharing and collaboration within and across teams/units | 38.5% |

| Increasing engagement in knowledge management tools and approaches | 23.1% | Increasing the maturity of the knowledge managementprogram/effort | 30.8% |

| Capturing content and explicit knowledge | 23.1% | Promoting a knowledge-sharing culture | 30.8% |

| Using data and analytics to improve the flow of knowledge and expertise | 23.1% | Developing a knowledge management strategy | 23.1% |

| Eliciting and transferring tacit knowledge | 15.4% | Using data and analytics to improve the flow of knowledge and expertise | 23.1% |

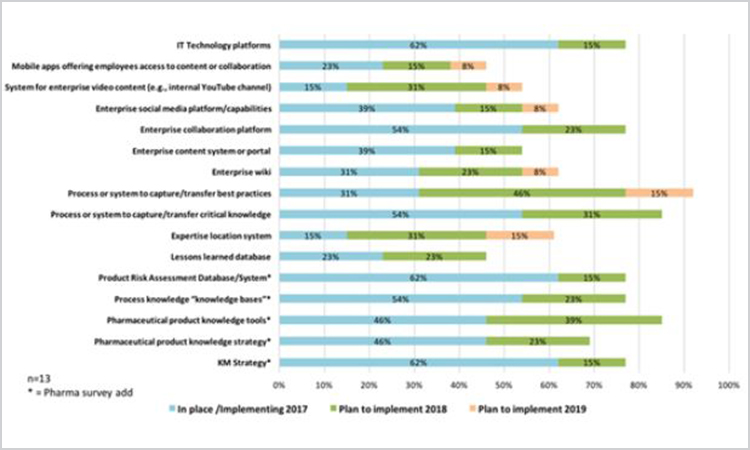

Finally, reflecting on knowledge management priorities, respondents were asked to list knowledge management approaches currently in place/implementing and planned for 2018–2019 implementation. The approaches were derived from the 2015 American productivity and quality center survey, with addition of pharmaceutical-specific items: Knowledge management strategy, product knowledge strategy, product knowledge tools, technology platforms, process knowledge platforms, and risk assessment database/system. Results for the pharmaceutical survey are given in Figure 12.

Figure 12. Knowledge management priorities in pharmaceutical survey (n = 13).

Although this data set shows great promise, it is important to realize that 13 respondents from 11 unique organizations answered this question. It is notable that “process or system to capture/transfer best practices” ranks highest in overall intent, and also shows the most planned activity over each of the next two years, signaling this is a hot topic in the industry. This is arguably consistent with the top driver of “improving operational effectiveness” (Figure 5), as best practices would be a key lever to accomplish this. Probing the pharmaceutical-specific topics, it seems the 13 respondents and their respective organizations are progressing on knowledge management approaches and processes to better utilize product and process knowledge.

Finally, looking forward, a question was asked how positive respondents felt about the future direction and of their organizations’ knowledge management efforts. Over 55% reported feeling “positive” or “very positive,” and 30% reported feeling “moderately positive.” None reported negative feelings regarding the future strategy and direction of their organizations’ knowledge management programs/efforts.

Pharmaceutical Industry–Related Topics

The final section of the survey contained questions focused on topics unique to the pharmaceutical industry. Guidance documents ICH Q8–Q11 were intended to provide a harmonized approach to science- and risk-based approaches for assessing changes across the life cycle. Several gaps still exist that have limited full realization of these intended benefits however, including operational flexibility for postapproval changes.

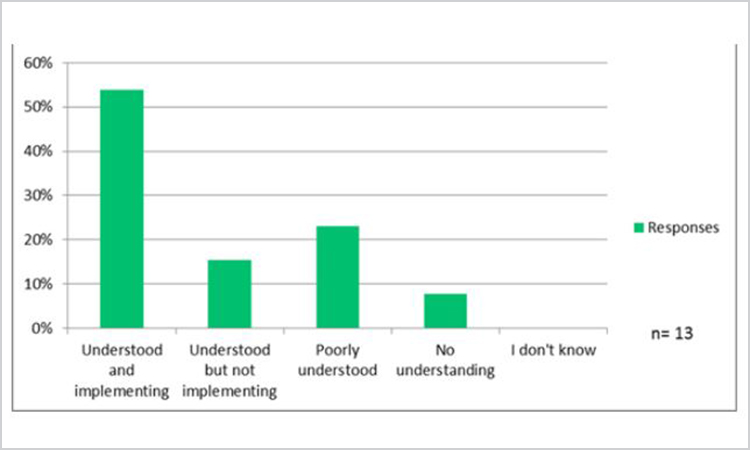

As ICH Q10 was adopted in 2008, the first question in this section sought to determine how well the ICH Q10 enabler of knowledge management was understood within the organizations (Figure 13).

Figure 13. Survey Question: “How well do you believe the ICH Q10 enabler of knowledge management is understood in your organization?” (n = 13).

Nearly 70% of the 13 respondents acknowledged understanding the knowledge management enabler role in ICH Q10, whereas the remainder reported poor or no understanding, suggesting a significant population remains to be educated. In addition, 54% of respondents indicated their organizations were implementing approaches to meet the intent of the ICH Q10 knowledge management enabler.

The next questions explored knowledge of the ICH draft guidance, which was in preparation during the survey period. Issued for industry consideration November 2017, Technical and Regulatory Considerations for Pharmaceutical Product Lifecycle Management: Q12 provides “a framework to facilitate the management of postapproval chemistry, manufacturing and controls (CMC) changes in a more predictable and efficient manner across the product lifecycle” [12]. The survey sought to understand the current level of awareness of Q12 and found that 85% of respondents were aware of the upcoming Q12 guidance.

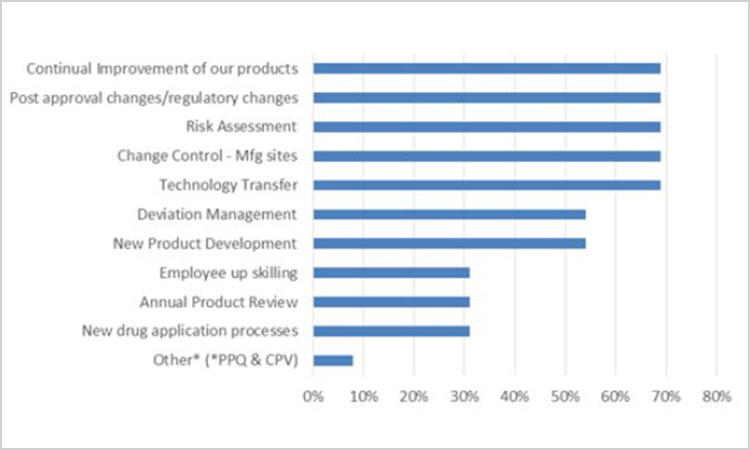

The final question presented a list of pharmaceutical business processes and asked respondents to select those they felt could benefit from additional knowledge management focus/application. Respondents could select all that applied (Figure 14).

Figure 14. Survey Question: “Which processes could benefit from additional knowledge management focus/application?” (n = 13).

Only one respondent chose “other,” specifying process validation—process performance qualification and continuous process verification—which may potentially be included in continuous improvement or technology transfer activities.

Conclusions

Looking at the survey results in aggregate, the authors submit the following assertions:

Opportunities

There is a lower level of organizational investment in knowledge management, indicated by fewer formal knowledge management roles (44% in the pharmaceutical survey vs 73% in the Knoco surveys) (see the “Demographics” section) and smaller knowledge management teams (Table 2). This may simply indicate an early point in the journey, or it may be a gap for the industry to address. Given the complexity of the pharmaceutical industry and much product complexity, it is logical that the pharmaceutical commitment of roles and team should, in time, at least be on par—if not higher—than the averages of other industries.

Pharma may be overlooking key elements of a holistic knowledge management program including:

- Key change management and related enablers. As evidenced by Figure 11, pharma ranked significantly lower than the Knoco benchmark for knowledge management reference materials, policy, training, metrics, or any related incentive program. Missing any of these focus areas may be acceptable but missing several—which collectively help people understand direction, build capability, measure progress, and reward positive behavior—is clearly a risk, and may indicate why implementation is progressing slowly.

- Business case. Less than 50% of respondents reported having a knowledge management business case (Figure 11), which means knowledge management is not linked to business objectives. Interestingly, a higher percentage have reported a knowledge management strategy (2x the rate of having a business case), so one may ask if perhaps the knowledge management strategy adequately defines the business case, is too disconnected, too localized, or associated with a single function (e.g., IT, technology, or quality).

- Implementation approach. As suggested in Figure 7, the only areas in which knowledge management leads the Knoco benchmark for the “how” implementation are to introduce processes, being undecided yet/other, and hope for viral growth. Key categories in which pharma is lagging include leveraging pilots and leveraging change management. One interpretation is that pharma's approach is more of a “build it and they will come,” vs experimentation and helping people through the change.

There is clear acknowledgment of the need for knowledge management to improve product knowledge, evidenced by the evolving understanding of knowledge management as an enabler of ICH Q10 (Figure 14), and top priority focus areas, including continual product improvement, postapproval changes, risk assessment, change control, and technology transfer. Yet as per previous observations, we know knowledge management is at a more nascent stage in pharma. There is an opportunity to realign the knowledge management business case with these priorities to create more focus.

Strengths

There is a positive outlook for the future of knowledge management programs in pharma, as evidenced by an overwhelming response in positive perception. Further, knowledge management in pharma suggests it will continue to advance, with respondents indicating intended growth in knowledge management capability in all of the 16 priorities discussed (Table 3).

There is a promising recognition of the role of tacit knowledge—a potentially underutilized knowledge asset—as evidenced primarily by the prioritization of knowledge management approaches (Figure 6), where “knowledge retention,” “learning from experience,” “connecting people,” and “best practices” are each highly prioritized.

Knowledge management in pharma is headed in the right direction and is directionally aligned with other industries, based on generally aligned business drivers (Figure 5). Pharma-centric drivers are intermingled, not leaders or laggards that could send pharma in a different direction. Further, the prioritization of knowledge management approaches and priorities (Figure 6) suggests the approaches are largely from the same solution set, so there is a huge opportunity for knowledge management in pharma to accelerate, learning from others.

The authors urge the pharmaceutical industry to reevaluate this survey or conduct a more in-depth survey on a focused topic (e.g., change control, technology transfer, continuous improvement) in coming years to keep a finger on the industry pulse and highlight best practices.

In closing, the key questions are:

- How do we leverage the positive perception and promise of knowledge management in our industry?

- Can we break through the adoption curve by using the learnings that exist in other industries?

Some initial clues exist, but clearly more work needs to be done.

- 2Wiig, Karl Martin, B. C. Towe, and Vincent Pizziconi. “Knowledge Management: Where Did It Come From and Where Will It Go?” Expert Systems with Applications 13, no. 1 (July 1997): 1–14. doi: 10.1016/S0957-4174(97)00018-3

- 3Trees, Lauren, and Cindy Hubert. “Accelerating the Opportunity for the Pharmaceutical Industry through Knowledge Management.” Chapter 4 in A Lifecycle Approach to Knowledge Excellence in the Biopharmaceutical Industry, edited by N. Calnan, et al. Boca Raton, Florida: CRC Press, 2018.

- 4International Conference on Harmonisation of Technical Requirements for Registration of Pharmaceuticals for Human Use. “Quality Risk Management: Q9.” 9 November 2005. http://www.ich.org/fileadmin/Public_Web_Site/ICH_Products/Guidelines/Quality/Q9/Step4/Q9_Guideline.pdf

- 5Expert Group on Future Skill Needs. Future Skills Needs of the Biopharma Industry in Ireland. August 2016. http://www.skillsireland.ie/Publications/2016/Biopharma-Skills-Report-FINAL-WEB-VERSION.pdf

- 6Moritz, Bob. “4 Concerns That Keep CEOs Awake at Night.” World Economic Forum. www.weforum.org/agenda/2017/01/4-concerns-that-keep-ceos-awake-at-night/

- 7International Conference on Harmonisation of Technical Requirements for Registration of Pharmaceuticals for Human Use. ICH Harmonized Tripartite Guideline. “Pharmaceutical Development: Q8 (R2).” August 2009. http://www.ich.org/fileadmin/Public_Web_Site/ICH_Products/Guidelines/Quality/Q8_R1/Step4/Q8_R2_Guideline.pdf

- 8Moustaghfir, K., and G. Schiuma. “Knowledge, Learning, and Innovation: Research and Perspectives.” Journal of Knowledge Management 17, no. 4 (2013): 495–510. doi: 10.1108/JKM-04-2013-0141

- 9Knoco, Ltd. Global Survey of Knowledge Management, 2014.

- 10Knoco, Ltd. Global Survey of Knowledge Management, 2017.

- 11 a b American Productivity and Quality Center. 2015 Knowledge Management Priorities Data Report. 16 February 2015. www.apqc.org

- 12International Conference on Harmonisation of Technical Requirements for Registration of Pharmaceuticals for Human Use. ICH Harmonised Guideline. “Technical AND Regulatory Considerations for Pharmaceutical Product Lifecycle Management: Q12.” Draft version, 16 November 2017. https://www.ich.org/fileadmin/Public_Web_Site/ICH_Products/Guidelines/Quality/Q12/Q12_DraftGuideline_Step2_2017_1116.pdf

- 13Waldron, Kelly, Emma Ramnarine, and Jeffrey Hartman. “2015/2016 Quality Risk Management Benchmarking Survey.” PDA Journal of Pharmaceutical Science and Technology 71, no. 5 (September–October 2017): 330–45. doi: 10.5731/pdajpst.2017.007526

Acknowledgment

The authors would like to thank the additional members of the ISPE Working Team that contributed review of the survey questions: Jose Cardoso Menezes, Rob Guenard, and Teresa Pedersen.